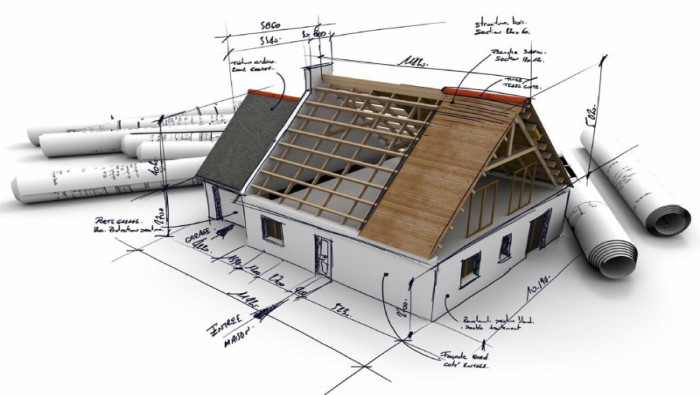

Builder’s Risk

Protects residential and commercial properties under construction, either ground up or remodel.

Builder’s Risk Insurance, also called Course of Construction, is a policy protecting residential and commercial projects & properties under construction. It covers the material & labor costs associated with the project but is a versatile policy that can be customized to fit the project’s needs, providing additional coverages for soft costs, tools & equipment, even profit if desired.

The impact of accidental and unpredictable events can be disastrous to your construction project. Builder’s Risk insurance is meant to get the project resumed quickly by providing the finances to replace lost or damaged covered property. When estimating the limit of coverage required, it is important to remember the policies are based on the estimated completed value of the project (labor + materials), excluding land value. For remodel projects, the existing structure should be valued with depreciation accounted for; a good resource to check for this value is your property tax bill under the “Improvements on Land” section.

Builder’s Risk policies can be written for projects as short as 3 months as well as for projects that last multiple years. Insurance carriers are usually able to extend the policy at least once if the project is not completed on time. Reporting form policies are also available for home flippers, spec home builders, and developers that may have multiple projects underway at a time.

Most Builder’s Risk policies are written on a “all risk”, also called “special”, cause of loss form, meaning only the perils not specifically excluded on the policy are covered. Losses caused by fire, theft, vandalism, lightning, wind (depending on location), and hail are typically covered. Common exclusions are earthquake, flood, war, mechanical breakdown, and government action.

A policy can also provide many additional coverage such as property in transit & storage, debris removal, extra expense, and soft costs like architect & engineer fees, permit costs, even insurance premiums.

How Much Does It Cost?

Builder’s Risk insurance policy pricing is based primarily on the construction costs for the project. For both new construction and remodel projects, the resale and land values are not used to determine construction costs. There are a few other factors that may influence the cost of the policy as well.

Pricing Factors:

- Construction Cost

- Location

- Project Length

- Coverages Desired

Call For a Quote:

855-95-SHIELD

F.A.Q.

If you have a question about Builder’s Risk insurance you don’t see answered here, please use the Contact Us box below. We’ll get right back to you!

What is Builder's Risk Insurance?

Simply put, Builder’s Risk insurance covers a structure while it is under construction. In the event of a loss, the policy will cover the material and labor costs to complete the project; not the estimated resale or market value of the structure once its complete. It can cover ground-up projects like residential & commercial new construction or remodeling projects & tenant improvements. Also called Course of Construction Insurance, Builder’s Risk insurance protects the insured against physical and/or financial loss arising from the increased risks associated with a construction project.

Why do I need it?

The impact of accidental and unpredictable events can be disastrous to your construction project. Builder’s Risk insurance is meant to get the project back on track quickly. If you’re a homeowner, most Homeowner Insurance policies do not provide coverage for properties under construction or remodel. If you’re a spec home builder or developer, most construction lenders require you to carry a Builder’s Risk policy but more importantly, inadequate coverage could mean disaster to your project’s bottom line and your business.

What does it cover?

Builder’s Risk insurance primarily covers the material and labor costs associated with the construction or remodel of a home or building. Materials or equipment that become a permanent part of the structure once complete are covered. Construction materials such as lumber, drywall, plumbing & lighting fixtures, HVAC units, and other materials are all prone to damage or loss during construction. The cost and time to replace these materials can significantly delay or even terminate a project. A policy can also be written to cover the soft costs of a project; items like permit costs, insurance premiums, estimated profit, architect fees, and construction loan interest.

What is NOT covered?

Most policies will exclude losses due to earthquake and flood, and depending on the location of the project, wind could be excluded as well. A Builder’s Risk insurance policy will not cover any bodily injury claims that arise from the project, these would be covered under a General Liability or Worker’s Comp policy depending on who was injured. Also, contractor’s tools and equipment are not covered under most policies, these would be covered under an Inland Marine/Tools & Equipment policy.

How fast can I get it and what do you need from me?

For most projects, a policy can be quoted and issued within a couple hours. If the project has already been underway for some time or a remodel project is making structural changes to the building the process can take a couple days. Necessary information required to provide a quote is:

- Location of project

- Construction costs

- Estimated length of project

- Existing structure value (Remodel projects only)

Related Articles

Replacement Cost vs Actual Cash Value

How big of a check will you get from your insurance company in the event of loss? The answer lies in how your property is valued. Find out the difference.

Builder's Risk 101

Also called Course of Construction insurance, a Builder’s Risk insurance policy protects a property under construction. Find out what it covers, who needs it. and why in this informative article.